The effects of the Biden administration’s Inflation Reduction Act can already be seen in various ways in the EV market. And one of them, recent data suggests, is an abrupt uptick this year in the portion of EVs leased rather than bought.

While the IRA re-upped the federal EV tax credit of up to $7,500 for qualifying vehicles, it established some additional ground rules that starting in 2023 made it more restrictive than in years past. Price caps apply, of $55,000 for new cars and $80,000 for pickups, SUVs, and vans—which required some clarification on the electric SUV list. New requirements for income apply too, with the credit only applicable toward households making an adjusted gross income of $300,000 or less for married joint-filing couples, $225,000 for heads of household, or $150,000 for other filers.

It also included EV battery and sourcing requirements. But due to the complexities of the rules, the U.S. Treasury Department delayed those credit qualifications and didn’t enact them until April 18—well after the start of the 2023 tax year.

When it enacted them, the list of models allowing the top credit amount got shorter. It reduced the credit amount for a number of EVs that used foreign-sourced batteries but otherwise were American-assembled—the Ford Mustang Mach-E, for instance, with its Mexican assembly and Poland-made battery.

2024 Ford Mustang Mach-E preview

The EV leasing loophole

Meanwhile, the so-called EV tax credit loophole for leasing was already written into the IRA. Called the Commercial Clean Vehicle Credit, or IRS 45W, it was originally written with the intent to allow the operators of large fleets a subsidy.

But the way it was written—not at all an accident—an automaker’s captive finance partner can claim the same incentive, of up to $7,500 for EVs with a gross weight rating under 14,000 pounds (or more for heavier vehicles), for private individuals leasing a vehicle. They may choose to apply some or all of it toward the lease, or pocket the credit. And it isn’t subject to any of the restrictions for assembly location, critical minerals, household income, or sticker price that the purchase tax credit is.

In the first several months of 2023, most automakers soon rolled out reduced lease prices effectively subsidized by the federal government—many of them for imported EVs and luxury models. Some companies, like the U.S. EV maker Lucid, didn’t waste any time in applying a direct capital cost reduction to their leases—in January 2023—effectively cutting monthly lease rates. Others initially decided to claim the credit but not to apply it to reduced lease prices.

Meanwhile, there’s been a sharp rise in loan rates, making it much more expensive to finance a vehicle purchase. According to Experian, the average loan rate stands at 6.63% for Q2 2023—up astronomically versus the same period in 2022 and 2021, at 4.60% and 4.17% respectively.

So around April, some of the EV market dynamics changed. It might not have been quite as attractive to buy an EV, while leasing got a little sweeter.

Lucid Air Pure

The shift toward EV leasing

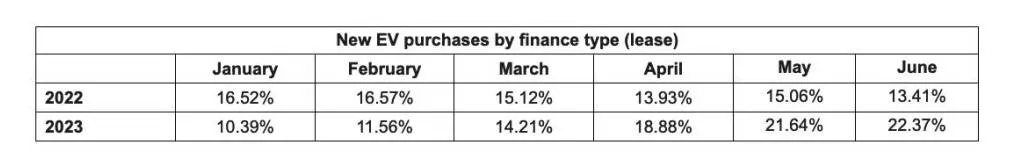

Data from Experian suggests that the EV market might be shifting toward leasing as a result.

Portion of new EVs leased – Experian

Looking at the first half of 2023 versus the first half of 2022 (above), the proportion of new EVs leased (versus bought) dropped about 5% lower in January and February versus the same months in 2022. But by April, the trend had reversed in the other direction, with leasing percentages about 5% higher versus the year before.

For June—the most recent month of Experian data—EV leasing stood at more than 22% of the market. And the firm revealed earlier this month in its latest State of the Automotive Finance Market report that leases of the Tesla Model 3 are up significantly, and it now ranks among the most-leased vehicles in the U.S. market.

Terms and payments, leasing vs. buying – Experian

The effect might also be seen industry-wide in average monthly lease payments. They stand at $586 for Q2 of this year, versus $553 for the same period last year. But average loans are at $729 a month for Q2 this year, versus $672 for Q2 last year. So while loans have risen 8.8% year over year, leases have risen less than 6.0%.

Green Car Reports has reached out to a number of automaker finance firms as well as the IRS seeking any data summing the frequency of 45W claims in EV lease financing. Up until now the companies that have replied have declared such information private, so we may need to wait until next year, when the IRS might retroactively provide it.

Obviously the trend toward leasing EVs is not only due to the leasing loophole. But it’s one of several ways the growth of the EV market appears to have accelerated due to the IRA.