Ford announced on Monday that it’s planning the installation of lithium iron phosphate (LFP) batteries into its Mustang Mach-E starting later in calendar year 2023 and its F-150 Lightning in calendar year 2024.

The shift will potentially bring lower EV prices, although that will “depend on what happens with the market,” according to Ford Model E chief customer officer Marin Gjaja.

The executive added: “The whole intent here is to make these more affordable and accessible.”

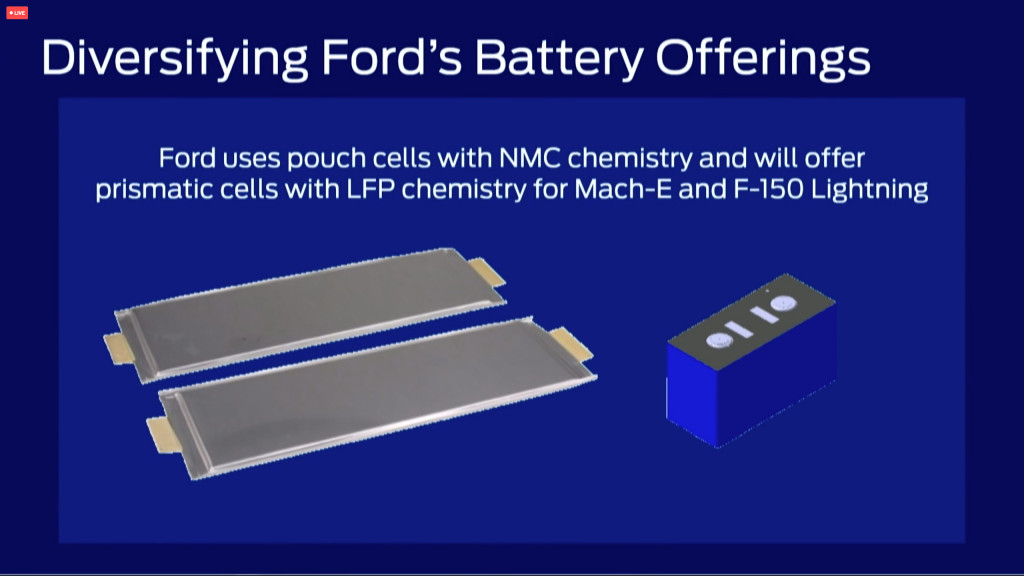

Mach-E Standard Range will get LFP cells starting later this year, F-150 Standard Range early next year—with the shift potentially not happening all at once but a trim level at a time. Extended Range and anything performance-oriented will stay with the existing nickel manganese cobalt (NMC) chemistry that’s used in those models today.

From 2026, LFP cells for Ford products will come from a Michigan battery plant established with technology from China’s CATL. In the meantime, cells for these products are likely to come from one of CATL’s plants in China.

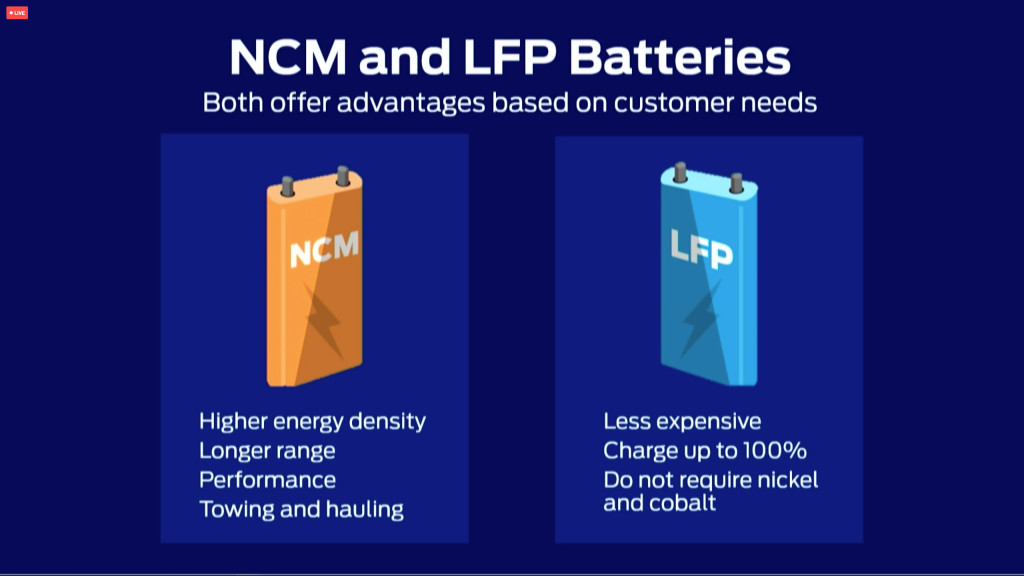

Ford comparing NCM and LFP battery types

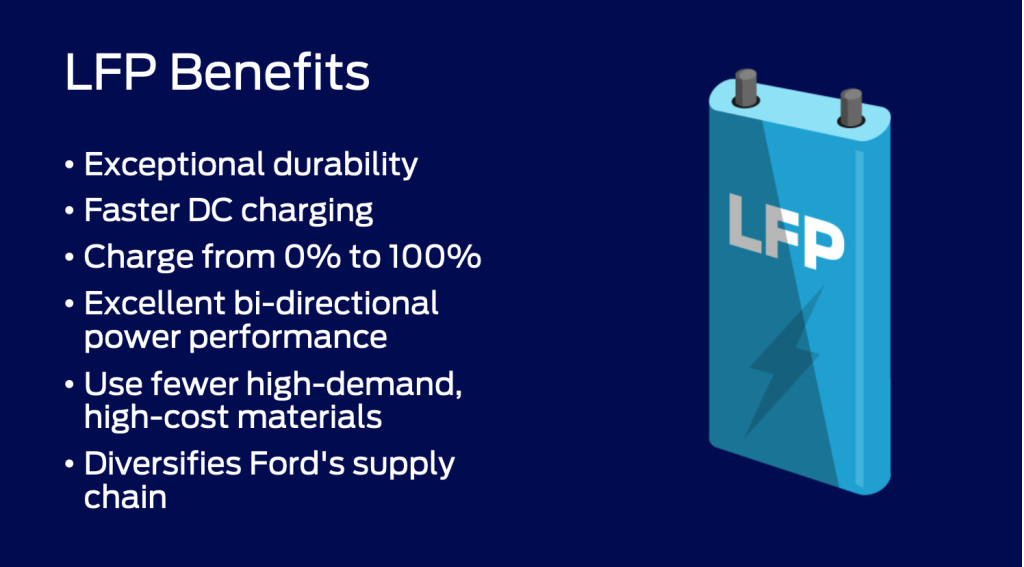

Ford LFP battery benefits

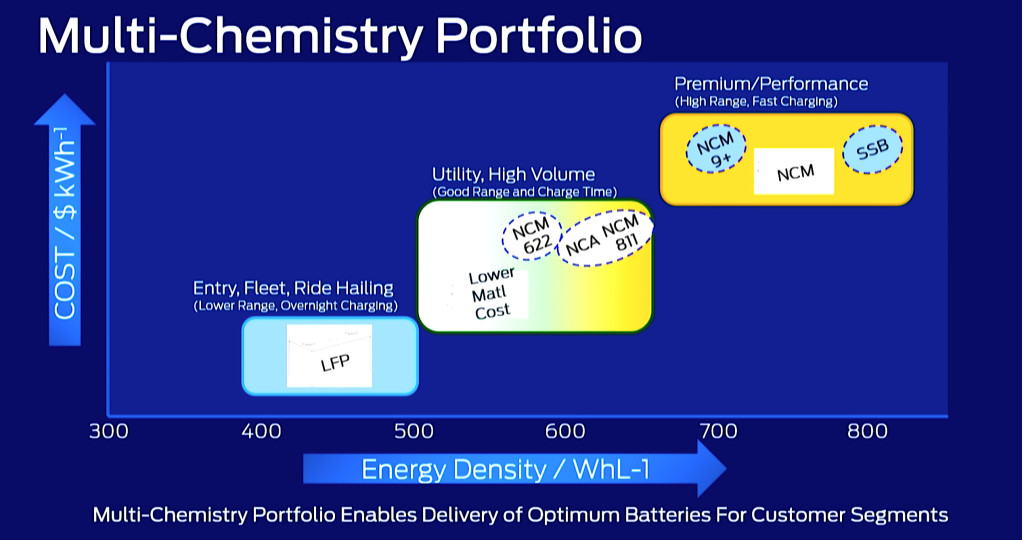

Reasons behind the shift to LFP

In a presentation Monday, Ford outlined some of the reasons behind the shift. LFP batteries have exceptional durability, and they can help strengthen the supply chain while using fewer high-demand, high-cost materials and mineral resources. Further, they can be charged from 0% to 100% daily—something that’s not recommended for the NCM chemistries that are currently used in the F-150 Lightning, Mustang Mach-E, and E-Transit if full range isn’t needed.

Ford also noted that because of these characteristics, LFP batteries are also a preferred choice for bidirectional charging, as is already offered with an F-150 Lightning home power backup system.

On the other hand, LFP cells are typically sluggish and slower to fast-charge at the coldest ambient temperatures. They’re also not the best pick for high performance or the longest range, partly because they pack more weight for the same energy; but as Ford emphasized in the strategy below, it only sees LFP batteries as primarily satisfying the fleet and entry-level portion of the market.

Ford multi-chemistry approach for EV batteries

A different kind of lithium-ion

As a subset of lithium-ion battery tech, LFP cells use lithium iron phosphate as the cathode and graphite as the electrode. These cells are far less prone to the thermal runaway that might cause fires or degradation from overheating, but a range of sources now suggest they last significantly longer.

LFP cells aren’t dependent on nickel and cobalt, two materials that are expensive, supply-constrained, and a big lift for the supply chain.

Roughly one-fifth of the world’s electric vehicles are powered by LFP cells. The technology, led by China’s BYD a decade ago, has advanced in its latest form in the BYD Blade battery, while CATL is also a leading producer.

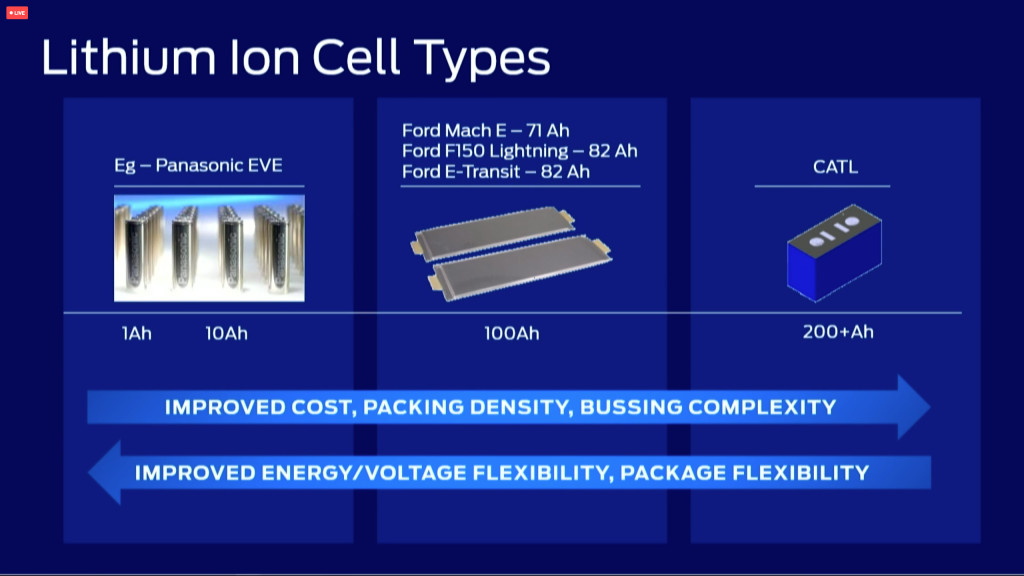

Ford comparing battery form factors, in shift to LFP

Ford-CATL LFP prismatic cells for Mach-E, F-150 Lightning

Change in form factor, too

The battery chemistry won’t be the only thing that changes in vehicles that make the shift to LFP, Ford executives noted. The battery form factor will be entirely different, too. These models will use prismatic cells versus the pouch cells used in current models; and they’ll be larger. Ford noted, at more than double the capacity in ampere-hours.

That means less bussing between the cells themselves, which helps mitigate some of the energy losses from these less energy-dense cells, Ford explained.

Ford didn’t explain further what this means for the future in actual pack layout—or to what level it potentially means skipping modules or packs in the future. CATL, for instance, has what it terms a “disruptive” water-cooling design that enables a cell-to-pack layout with impressive energy densities to rival that of those more expensive cell types.

2023 Ford F-150 Lightning

Informed by data and bottom-line cost

The company did underscore that the shift to LFP cells was part of a decision to diversify its battery offerings to better fit product usage and customer needs.

Ford’s connected vehicle data team has been studying aggregated, anonymized vehicle data to understand how its EVs are used. And from that, it found the average Mustang Mach-E driver typically goes just 32 miles a day, with a trip distance averaging just five miles at a time. Further, 95% of Mach-E customers start their trips at ambient temperatures above freezing.

It says that it doesn’t have a full year of data on F-150 Lightning use yet, but it’s already seen that 89% of customers start their trips above freezing.

2022 Ford E-Transit

Ford didn’t confirm that LFP batteries are also headed into its E-Transit delivery vans soon, but as its own chart above showed, fleet vehicles seem to meet the profile of models that are charged to 100% daily.